By now, you know there are three major credit bureaus – TransUnion, Equifax and Experian. But you probably wonder why there are three. After all, don’t you have just one score? How could three credit scores give the same, consistent information?

Here’s the answer to both questions: you have more than one credit score and not all three credit bureaus report the exact same information. This revelation is often shocking if not confusing. Fortunately, the differences between these bureaus are easy to explain.

Credit Bureaus Score Things Differently

The major distinction between the three credit bureaus revolves around their credit scoring models.

A credit scoring model is the criteria a bureau uses to assign you a credit score. There are quite a few models out there. However, the two main ones are FICO (used by 90% of lenders) and VantageScore (used by roughly 10% of lenders). Even the FICO and VantageScore models have multiple variations.

Things get a bit more complicated when lenders get involved since they too have their own way of calculating scores. Essentially, you have dozens of scores which in theory, could mean that your credit is all over the place.

Yet Still, Your Score Isn’t All Over the Place

As messy a setup as it sounds, the numbers generated by the three credit bureaus are likely closer to each other than you think.

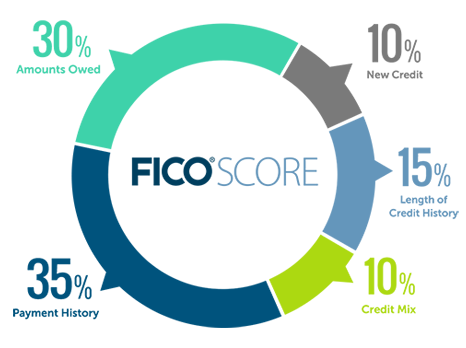

What’s reassuring is that the bureaus tend to calculate your score based on similar factors. They all look at the five key components of your credit profile: your credit utilization ratio, payment history, credit mix, credit age and new credit opened. In case you’re drawing a blank, here’s a look at the FICO breakdown:

TransUnion, Equifax and Experian use this exact same model to calculate your score. With that said, the different models of the FICO score (pictured above) and VantageScore may assign weight to certain factors just a bit differently.

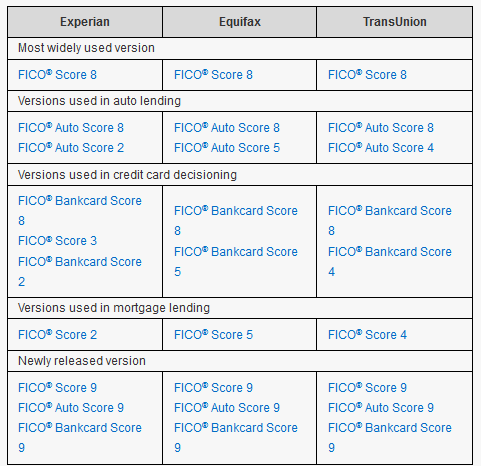

For example, FICO Auto Score focuses more on auto loans and financing. So this particular scoring criteria would put more emphasis on auto loan payment history as a factor when calculating your credit score.

Likewise, FICO Bankcard Score looks more intently at your usage of credit cards, and factors in your credit card balance and payment history to calculate your overall score.

This chart shows you all of the variations among the FICO scoring model alone.

Ultimately, these scoring models are relatively minor in difference overall. Some put a little more emphasis on certain credit accounts, but in the long run, all three bureaus will arrive at a similar number when calculating your score.

How Those Differences Affect You Personally

Now for the part you’ve been waiting for: how do these differences affect you personally? It depends on how you look at it.

For the most part, if you have all the good habits – you pay your bills on time, don’t miss payments, don’t carry huge balances – your credit score will be good, great or excellent. The differences won’t really make a difference.

The opposite is true as well – a pattern of missed or late payments, and high balances will likely mean a less-than-ideal credit score, regardless of who’s calculating it.

Of course, there are some instances where your credit score may not be consistent across all models and among the three bureaus.

When the Differences Are Significant

If your credit report has an error or delinquency under one bureau, and not the others, then you might see a noticeable difference among the three. This happens more common than most realize and can be a real headache, especially if you want to apply for a loan or credit card.

Why Errors & Misinformation Happen

- Inaccurate information submitted by lenders

- Incorrect account reporting

- Inaccurate data entered by the bureau themselves

- Lenders reporting info at different times

- Applying for credit under a different name

- Unauthorized or fraudulent credit pulls/inquires

- Identity errors, theft or fraud

If you notice a major gap in your credit score, the best step to take is to submit a credit dispute. You likely have some data or information that needs to be added, updated or removed.

Three Different Credit Bureaus, One Unifying Principle

Ultimately, the advice to take away from this post is to not get too hung up over the three credit bureaus. Regardless of what you do, your scores will likely never be the same exactly.

Instead, focus on establishing good financial habits such as paying your bills on time, reducing your debts and having the right mix of credit. Doing so will likely earn you a good, great or excellent credit score from all the bureaus no matter what scoring model they use.