The word “subprime” might leave a bad taste in your mouth. After all, many blame excessive subprime mortgage lending as the reason for the 2008 recession (although this has been disputed). Also, many people have simply had bad experiences with subprime lenders in general.

Then again, subprime lending has helped some to manage serious difficulties, especially when juggling poor finances and tough life circumstances. At times, they’ve managed to turn the tables so-to-speak, and gradually nurse their finances back to health.

If you’re considering a subprime loan because of your poor credit, it’s important for you to know the ins and outs of this double-edged sword. The more you know about these loans and their lenders, the better your decisions towards them will be.

With Subprime Loans It’s Sink or Swim

Ultimately, a subprime loan isn’t much different from a low-interest loan. In fact, many banks and institutions that offer prime loan approvals also provide subprime loans as well. The main stipulation, of course, is your credit score – if it falls below a certain number (usually between 620 – 650), then a subprime loan becomes an attractive option.

In times of crisis, these loans can serve their purpose. For example, a family in desperate need of a car to commute to work but feeling the effects of outstanding debt may only qualify for a subprime auto loan. While someone may judge such individuals as irresponsible, it’s important to remember that some people fall into hardships – poor credit is not always a choice.

In those moments subprime financing can seem like a lifeline. However, they are not perfect and there are disclaimers to know well in advance.

The Risks of a Subprime Loan

Subprime auto loans, mortgages or any type of financing come with challenging conditions. Not everyone will experience them the same way, but they will take some adjusting to.

Higher Interest Rates

The most well-understood challenge of a subprime loan are the high-interest rates. For example, a prime auto loan may come with an interest rate as low as 2% (or less), depending on one’s credit history and score. A subprime auto loan, however, often brings interest rates in the double digits, anywhere from 10-15%. And in extreme cases, some individuals pay more than 20% in interest, a reason why many see these loans are unethical. Generally speaking, the poorer your credit score and history, the higher your interest rate will be.

Long-Term Higher Costs

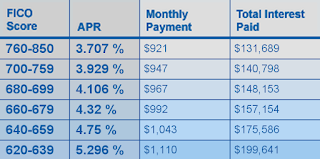

Higher interest rates always translate to more debt and larger outstanding balances over time. In other words, if you’re trying to get out of debt as it is, a higher interest loan will only drag out this process. In fact, just take a look at this chart below.

You can see how credit scores impact interest rates and monthly payments, and more importantly, the long-term costs (debt).

Understandably, certain situations may not present themselves with many options, but the effects of a long-term, high-interest loan are damaging nevertheless.

Potential Predatory Lending

There are memes and jokes about predatory lenders, especially in the subprime auto world. For example, you might see pictures of a flashy and eccentric car salesman selling what could be a lemon from a dealership at the edge of town.

They’re funny but at times true. There is a higher number of predatory lenders in the subprime market who take advantage of individuals in desperate situations. Unfortunately, some of this behaviour happens even within major financial institutions, as was seen during the lending crisis that contributed to the 2008 recession.

Generally speaking, these lenders persuade people to take on loans they know their customers will struggle to pay off. They might also falsify some of their information in order to get an approval for a loan. Worse, is that some of these institutions and lenders coerce people into paying loans with absurdly high-interest rates (30, 40, even 50%).

What Should You Do Before Applying For Subprime Financing

Accepting these risks are the first step to take when applying for subprime auto loans, mortgages or any loan due to subprime credit. These high-risk loans will only work in your favour if you use them strategically, which basically means paying them off as quickly as possible.

Subprime Financing To-Do List

- Consider Your Long-Term Financial Health – Look at your earnings, savings and debts. More importantly, review your financial goals. Decide whether adding on additional debts will set you too far back, or it if it’s a temporary “hiccup” you can deal with. You may need to work with a financial advisor or debt counsellor to make an objective decision about this.

- Do Your Research On the Lender – What’s the lender’s reputation like? Has the media reported on unethical lending practices they’ve engaged in? Do they get reviews from angry customers who feel abused or misled? Do they seem to genuinely guide their applicants to better financial circumstances? Strive to find definitive answers to these questions.

- Consider Alternative Methods – If your circumstances are not urgent, then you might not need to apply for a subprime loan at all. Patience in paying down debts will serve you best, as this will allow you to improve your credit score and apply for lower interest loans in the future.

- Work With a Debt Counsellor – One benefit of working with debt counsellors is that they offer solutions to finance problems that sometimes are right under our noses. Consider working with one of these professionals for this reason. You may assume that the only way to escape a tough situation is to go the subprime route when in reality, there are other solutions.

Tread Lightly With Subprime Loans

Keep in mind that the intent of this post is not to bash subprime loans. The purpose is to warn you about applying for such a loan without knowing its risks, especially for the long run. The desperation and ease at which some lenders offer these loans have been the reason why many were ruined financially.

If a subprime loan seems like your only option for a car or home, apply for one strategically. Your goal should be to refinance for a lower interest rate as soon as possible, so that you’re not tied down with extra debt over time.

Work with a financial advisor who can help you work the loan into your finances, so that you can make regular payments while reducing your debt. Doing so will help you improve your credit score, and hopefully, bump you into prime territory.