Apps are like supplements: they can’t make you stronger or any fitter, but they can help you reach your goals faster. The same goes for personal finance and credit apps. They won’t save money for you, but they can help you save money, and they won’t increase your credit score but they can make the hard work easier.

Fortunately, with the outpouring of startups and apps in today’s world, there are plenty of digital tools that can help you take charge of your finance. As long as you’re willing to do what’s necessary to improve your credit score, the apps mentioned in this post will get you to the score you want, faster.

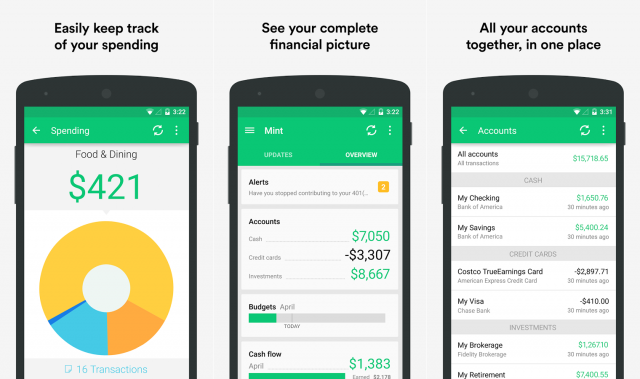

1. Credit Karma

Who it’s For

Credit Karma is for anyone who wants a comprehensive view of their credit profile and financial situation. It provides a combination of credit monitoring, security capabilities and financial guidance that gives you more control over your money.

What it Does

- Allows you to check your credit profile without taking a hit in points

- Detects possible ID theft if your info is compromised by a company’s data breach

- Helps you find unclaimed money in your name (you might literally be richer than you think)

- Provides money-saving tips and recommendations

- Monitors your credit report and alerts you to changes and potential errors

- Offers regular credit tips recommended to you based on your credit health

- Allows free tax filing for both federal and state returns regardless of your tax situation

Credit Karma grants you access to your credit profile without having to contact a credit bureau and take a credit hit

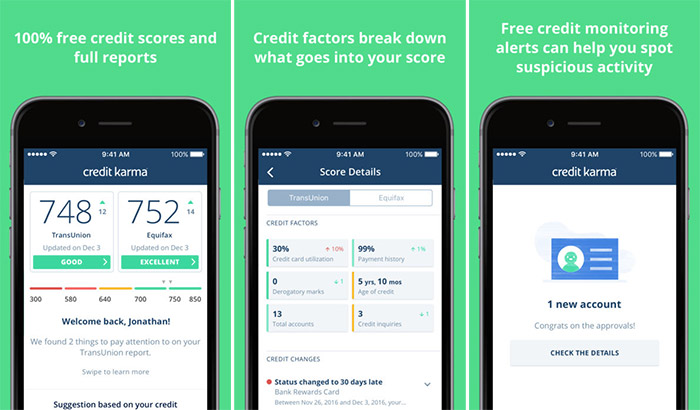

2. WalletHub

Who it’s For?

WalletHub seems like the typical credit monitoring app, but it comes with a twist that the financially meticulous and detail-oriented would like. What’s that? It provides free credit scores and full reports updated daily. It also serves as a “pocket assistant”, dishing out custom recommendations to help people manage their credit.

What it Does

- Sends free credit score reports updated daily

- Sends free credit reports updated daily

- Monitors your credit profile 24/7 and alerts of potential ID theft/fraud

- Delivers personalized savings alerts to help you reduce debt faster and prevent overpaying

- Provides personalized tips to help you improve credit

If you’re the kind of person who wants to monitor their credit like a hawk, then WalletHub is the app for you. You won’t miss a beat, and it’s empowering because you can maintain financial self-awareness on a daily basis.

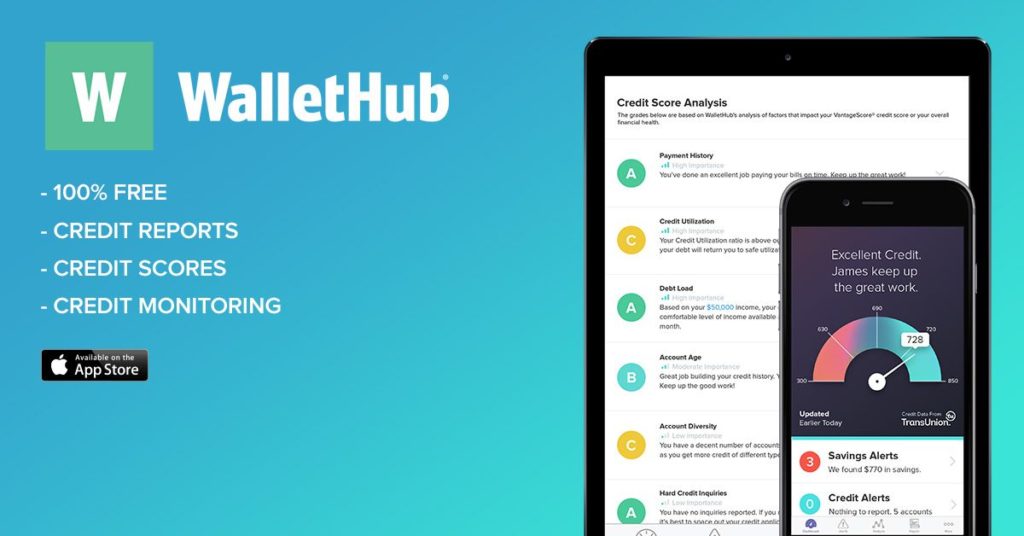

3. Mint

Who it’s For

Although not a credit app per se, Mint is great for those who want the big picture of their finance and to stay on top of things. And of course, staying on top of your bills and payments is the key ingredient for a higher credit score.

What it does

- Tracks your bills, account balances and transactions

- Provides a central hub to see your finances (no need to log in to multiple sites)

- Helps you create and stick to budget

- Provides alerts and reminders so that you don’t miss bill payments

- Protects your account with multi-factor authentication

- Offers money-saving and debt-reducing tips

- Not a credit app, but shows credit score for free

Mint works perfectly for those who are tired of surprise late fees, and want to cut the hassles of managing multiple finance tools. It’s also well reviewed, having appeared on multiple “best apps” lists, including Time Magazine’s The 50 Best Apps of the Year (2016).

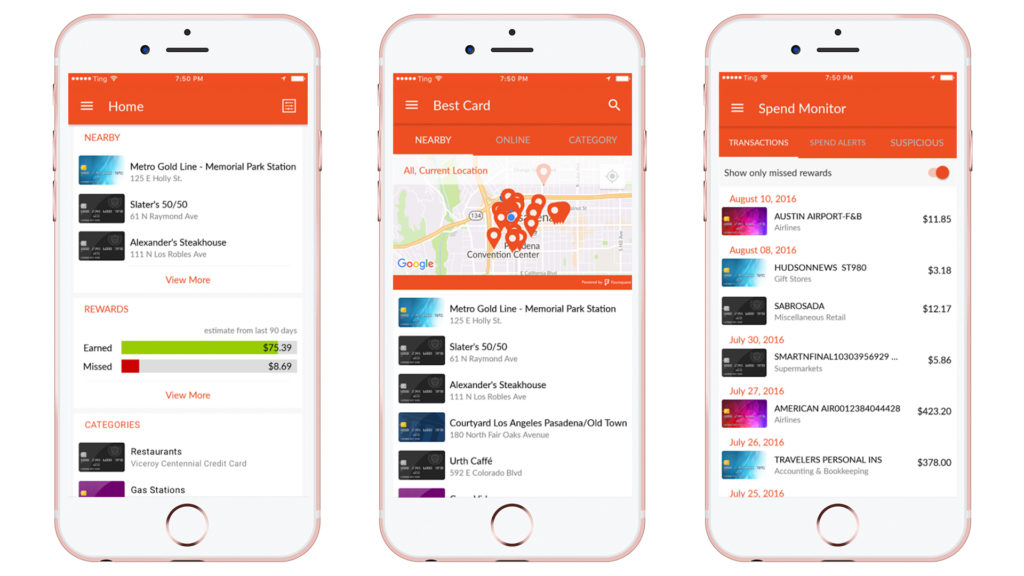

4. Wallaby (iPhone Only)

Who’s it For?

Wallaby is the perfect app for people who want to save hundreds of dollars without thinking too hard. In a nutshell, the app works by telling you which is the best card to use for a specific purchase. It’s not a credit app, but it can help you build better credit in the long run by helping you make smarter purchases.

What it Does

- Tells you which card to use for both online and offline shopping

- Notifies you on which card to use to maximize rewards

- Tells you when you’re using the wrong card and which card was better

- Ambient Alerts feature that uses GPS to send you notifications of which card to use depending on the stores you visit (can be turned off to save battery life)

- Provides history of your rewards/points collection

Wallaby gives you the inside scoop on reward points that no one really gives. Indirectly speaking, this app can help you with your credit score, because it can help you spend less which means more savings and less debt.

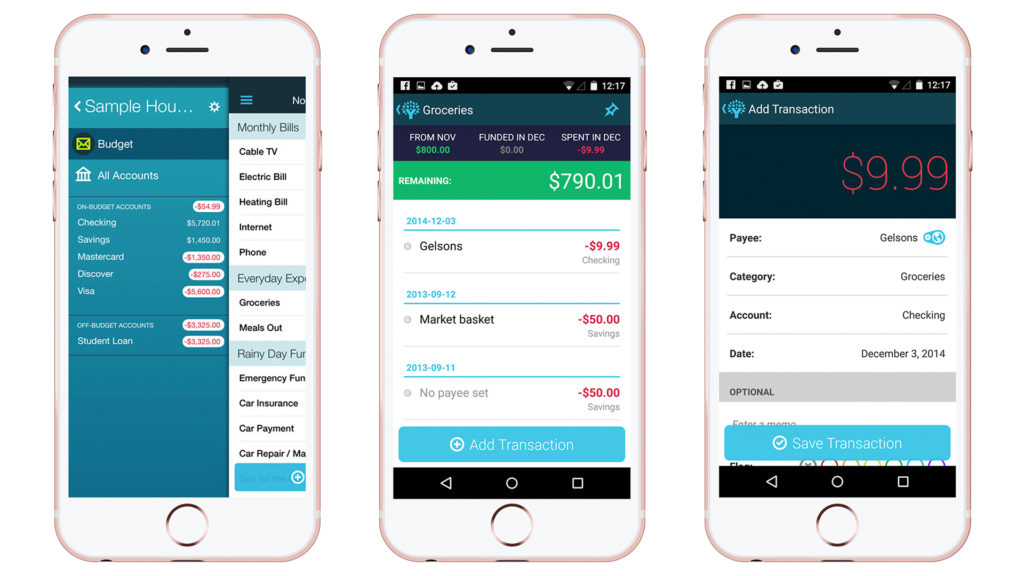

5. You Need a Budget (YNAB)

Who’s it For?

As stated on their website, this app is for all those who want to “stop living paycheck to paycheck, get out of debt, and save more money”. One of the key aspects of this app is that it scrutinizes every dollar spent, which is vital to repair credit.

What it Does

- Syncs to all bank accounts and provides one location to track your accounts

- Provides real-time access to your data which is shareable (ie. with a spouse)

- Visual displays and trend reports of your spending and saving habits

- Allows you to set and track finance goals

- Provides regular teaching tools and tips to help you get out of debt

- Offers 24/7 customer support via email, live chat and even 100+ free and weekly live workshops

Many of YNAB’s features focus on making every dollar count and work for you. This is a great philosophy because untracked expenses can lead to debt, and debt can worsen credit scores.

Want to Improve Your Credit Score? There’s An App For That!

Rest assured that your goal to improve your credit score doesn’t have to feel like climbing a mountain. Unlike your parents and grandparents, you have access to a wide selection of apps that can help you manage your credit and finances.

So take advantage of them. With some digital assistance (and personal effort), you will find yourself on the path to better credit, less debt and even a steadier cash flow.