It takes seconds to squander your money (just ask people who’ve made bad investments), but a lifetime to build savings that you can live on. Sorry, that’s just the way it works.

And that’s why it’s good to teach kids this lesson with their own money, whether they earn it from an allowance, a lemonade stand or a paper route (do kids still do that?).

If you’re currently in your 20s or 30s (heck, even 40s), this article is for you. Retirement may feel like it’s far, far away, but from where you are it’s important to treat it like an object in the mirror that’s closer than it seems.

We’re going to talk about the importance of saving for retirement now that you’re still fairly young. The earlier you start, the easier it will be to establish your foundation for tomorrow.

No Savings – A New Reality For Millions Of Americans

If you feel like you’ve got nothing saved, understand that you’re not alone. In fact, the next great epidemic the country will face won’t be a bad case of the flu, but rather, a lack of savings for retirement (among other things). And the outbreak has already begun.

Just take a look at some numbers:

- A survey of 2,003 adults found that 78% percent of Americans are extremely or somewhat concerned about not having enough money for retirement

- 21% of Americans have nothing saved for retirement and another 10% have less than $5,000 saved

- Approximately 19% of young people aged 18-34 have $0 saved for retirement

- Women appear to have less money saved for retirement than men (45% of women have no savings or under $10,000 in savings compared to 40% for men)

Now, these numbers aren’t looking too good, but the real picture of how dismal things can get comes from the stories of retirees living on limited funds. One of the great tragedies, now, are senior-aged Americans who will never know the joys of retirement because they have no savings to make it happen.

Take, for example, the story of Roberta Gordon published in The Atlantic. Never expecting to live to age 76, Roberta found herself working at a grocery store handing out samples to keep herself afloat. She makes a mere $50 per day.

She lives in an apartment in California’s Inland Empire, making $915 monthly through Social Security and Supplemental Security Income (SSI), which is designed for low-income seniors. Her rent is $1,040 per month, and she has to cover this by herself – her roommate died in August 2017. Unfortunately, Roberta has to use a credit card to cover what she can’t pay for on her own, and often goes to a church food bank for some necessities.

What led to Roberta’s heart-wrenching situation? She simply didn’t have enough savings for retirement due to never having a stable job that paid into social security (which meant no pension). Stories like these are grim yet cautionary tales of what retirement life is like when you’ve got little or nothing saved for your golden years.

So how can you prepare your nest egg for the days ahead?

Saving For the Days After Your Last Day

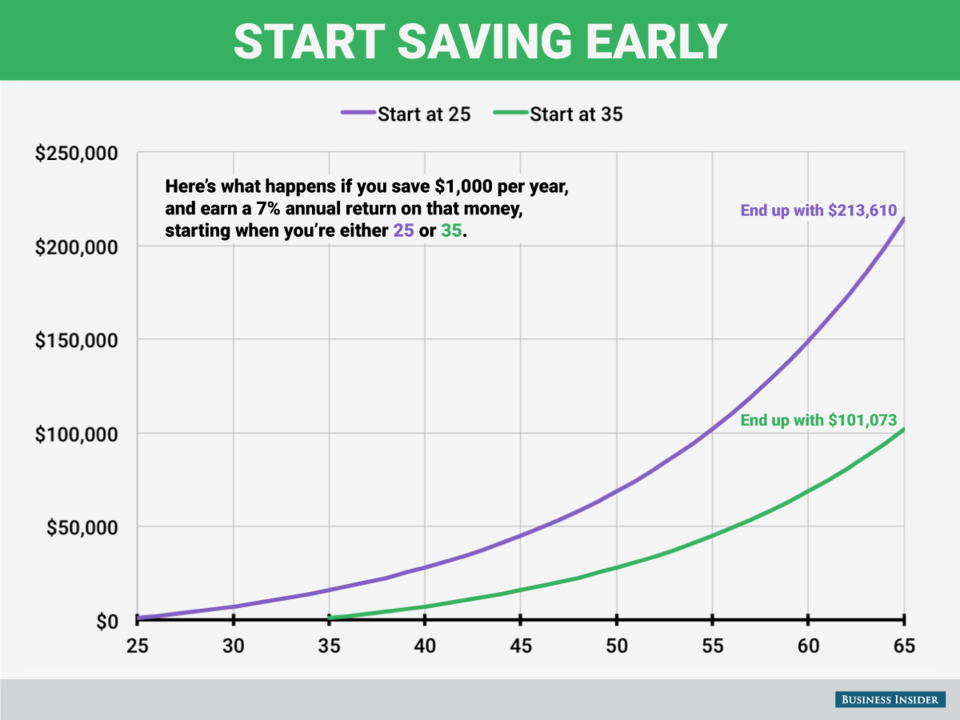

The key to having sustainable retirement savings is start early. Consistency is important too, but the time you start makes a big difference as well. In fact, take a look at this graph to get a glimpse of how retirement savings by age plays out into your future fund.

Retirement Savings By Age Recommendations

The chart pictured above is self-explanatory. The younger you start, the more money will be available to you for retirement due to the accruing of interest over time. Starting at age 25 is ideal because it gives you a significant headstart over someone who starts at 35 (the retirement amount is double if starting at 25). But even if someone starts saving at 35, they can still build an appreciable retirement fund that will carry them through retirement.

So the lesson with this is to start as early as you can, whether it’s 25, 30 or even 35. And if you’re past those ages, start now – the second best time after yesterday is today!

How To Build a Large Lump Sum For Retirement

Understandably, it’s difficult starting young because decades like your 20s and 30s are years where everything happens. There’s graduating from school, starting your career, travelling, dating and marriage, buying your first house, having kids and more. Trying to do all of that while trying to save and invest is tough. But it’s doable with the right strategy.

Set a Dedicated Amount You’ll Save Regularly

The simplest way to get started with a retirement fund is to set aside an amount of money you’ll save regularly. In the chart pictured in the previous section, the recommended amount stands at $1,000 per year. However, you can choose to set aside more or less. And it’s important that the amount you set aside fits comfortably within your budget.

That means it should allow you to pay off your bills, cover emergencies and pay down debts. What matters most is not necessarily the amount, but the fact that you’re putting this money aside without touching it and doing so regularly. You can set money aside per week, per month or at any interval that’s comfortable. Just after a few years of doing this, you’ll realize how much money you can accrue over time.

Open the Right Investment Accounts For Your Needs & Goals

Think all retirement accounts are the same? Well, they’re absolutely not. The retirement account you probably hear about the most is the 401K. The reality is that there are other options such as a Simplified Employee Pension account (SEP-IRA), Roth-IRA, and health savings accounts (HSAs). These three “alternative” retirement accounts each have specific purposes that may suit you better, depending on your current situation and future goals.

Three Other Retirement Accounts

- SEP-IRA – This retirement account is ideal for the self-employed, solopreneurs and even those with a side income. It allows you to make contributions as an employer instead of an employee and it has higher contribution limits than other retirement accounts. It’s one downside, however, is that if you have employees, you’ll have to give each of them an SEP-IRA and contribute the same amount to each account.

- Roth IRA – The great thing about a Roth IRA is that you can get a great tax break on the money you contribute towards it. But when you withdraw money from this account, you have to pay income taxes on it. Perhaps, the ultimate benefit of a Roth IRA, though, is that you get your tax break after you retire.

- HSA – As its name suggests, a health savings account (HSA) is a special account that’s combined with a high-deductible health insurance plan. It allows you to save money for medical expenses that may come up in retirement. Now here’s where HSAs get interesting: they give you tax breaks on both contributions, distributions and dividends/interest//capital gains (like traditional IRAs/401Ks). It gives you the best of many worlds.

Keep in mind that you may or may not qualify for any one of these accounts. And you’re also not limited to one account – you can open all three of them (even along with a 401K).

Match Your Employer’s Contributions

A good number of you work for companies where your employer can match your 401K plan. For instance, your employer may match 50% of your contribution up to 5% of your salary. So if you were earning $50,000 annually and you put $2,500 towards your plan, they can add another $1,250. Multiply that by a few decades and add interest on that, and you’ll see how much more you can get for your retirement – it certainly isn’t chump change.

Build Now, Relax Later

You’re probably familiar with the expression “strike while the iron is hot”. It’s definitely wise advice to follow if you’re a young adult in your 20s or 30s. True, it’s a challenge to invest during these years because you’re laying the foundation for so many other things. But ironically, it’s the best time to start since time and compounding interest is on your side.

And if you’re single, have no children or major commitments such as a mortgage, the advantage is even greater. So build your retirement base now rather than later – you’ll thank yourself for doing so when you say a final goodbyes to your workplace.